Build a Budget That Actually Works for Your Business

Most entrepreneurs treat budgeting like a chore they avoid until tax season. But here's the thing—when you understand how money moves through your business, you stop guessing and start making decisions that stick. Our autumn 2025 program walks you through the exact framework we've refined over twelve years working with Australian small business owners.

What You'll Actually Learn

Six modules spread across twelve weeks. Each one builds on the last, so by the end you've got a complete system—not just scattered tips.

Revenue Reality Check

Before you can budget, you need to know what money's actually coming in. We'll dig into your revenue patterns and find the stability points.

- Tracking seasonal fluctuations without spreadsheet overload

- Separating consistent income from one-off wins

- Building a baseline you can trust

Fixed vs Variable Costs

This is where most people get stuck. You'll learn how to categorize expenses in a way that makes sense for your specific business model.

- Identifying true fixed costs (hint: there are fewer than you think)

- Managing variable expenses without constant surprises

- Creating buffer zones for the unpredictable stuff

Profit Allocation Strategy

You didn't start a business to break even. We'll map out how to keep profit separate and actually pay yourself regularly.

- Setting realistic profit targets based on your industry

- The owner's salary conversation nobody wants to have

- Reinvestment decisions that compound over time

Cash Flow Forecasting

Budgets are useless if you run out of cash between invoices. You'll build a rolling forecast that shows exactly when money moves.

- Three-month ahead visibility without guesswork

- Handling payment delays from clients

- Timing your own payments strategically

Tax and Compliance Planning

Australian tax obligations don't need to be mysterious. We break down GST, PAYG, and super in plain language with practical tracking methods.

- Quarterly obligation tracking that prevents panic

- Setting aside the right percentages automatically

- Working with your accountant more effectively

Adjustment and Review Cycles

Your business changes, so your budget needs to flex. We'll set up a review rhythm that keeps you on track without constant overhauls.

- Monthly check-ins that take under an hour

- When to adjust vs when to stay the course

- Annual planning that informs quarterly decisions

Your Learning Journey

Twelve weeks from September to November 2025. Each phase builds practical skills you'll use immediately in your business.

Foundation and Assessment

We start by looking at where your business stands right now. No judgment—just honest assessment of current financial practices and pain points. You'll complete a baseline audit and identify your biggest budgeting gaps.

Building Your Framework

Now we construct the actual budget structure. You'll categorize all expenses, establish baseline revenue expectations, and create your first working budget document. This phase includes two group workshops where we work through real numbers together.

Testing and Refinement

Theory meets reality. You'll run your budget for a full month while tracking variances. We meet weekly to troubleshoot problems and adjust categories that aren't working. Most people discover they need to tweak 30-40% of their initial assumptions.

Advanced Forecasting

With a solid budget foundation, we add forward-looking cash flow projections. You'll learn to anticipate problems before they happen and make strategic decisions based on upcoming financial position rather than just current balance.

Systems and Maintenance

The final phase focuses on sustainability. You'll establish review routines, create decision-making frameworks, and build confidence in managing your budget independently. We also cover how to communicate financial information to partners, investors, or team members.

Who's Teaching This

Four financial professionals who've spent years helping Australian entrepreneurs get their budgets sorted. No theoretical experts—just people who do this work every day.

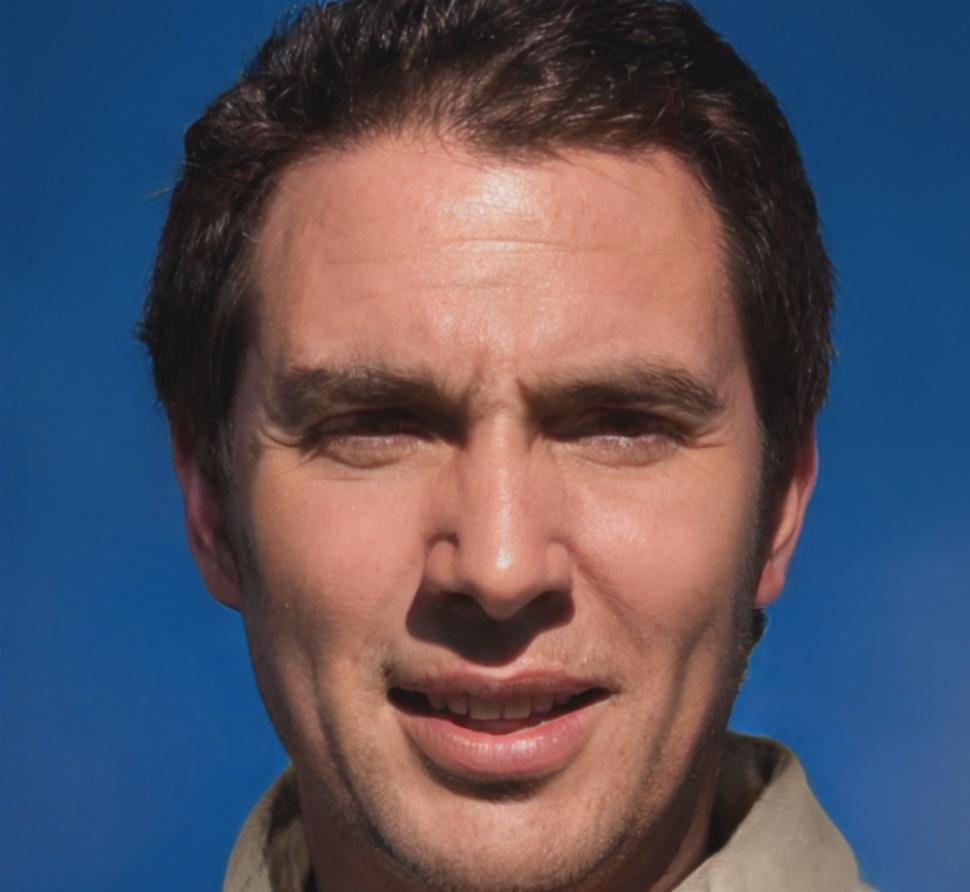

Kester Vaughn

Lead Instructor

Spent fourteen years as a management accountant before switching to small business consulting. Has worked with over 200 Queensland businesses on budget frameworks that actually get used.

Theron Whitley

Tax and Compliance Specialist

Former ATO officer who now helps entrepreneurs navigate Australian tax obligations without panic. Known for explaining GST rules in a way that doesn't require three reads.

Darian Copeland

Cash Flow Strategist

Runs a bookkeeping firm with eighteen clients, all of whom he's trained to forecast cash flow three months ahead. Believes most financial stress comes from not knowing what's coming.

Brennan Sheffield

Business Systems Consultant

Helps businesses build financial routines that don't fall apart after three months. His background in operations means he thinks about budgeting as a system, not just a spreadsheet.

How We Actually Run This Program

This isn't a course where you watch videos and hope it all makes sense. You'll work on your actual business finances with guidance from people who've seen hundreds of budgets.

- Weekly two-hour sessions on Tuesday evenings (6:30-8:30 PM AEST) so you're not giving up work days

- Maximum cohort size of twenty participants—we've found larger groups make it too hard to give individual feedback

- Direct access to instructors between sessions via our member portal for questions that come up as you implement

- Real budget reviews where we look at your numbers and troubleshoot together (all anonymized if you prefer)

- Template library with adaptable spreadsheets and tracking tools you can modify for your business structure

- Optional one-on-one sessions available for complex situations that need private discussion